You’ve just noticed that your roof has sustained some damage, and now you’re left with a conundrum – should you file an insurance claim?

It’s not a decision to take lightly. There are several factors to consider that could significantly impact the outcome. But don’t worry, we’re here to guide you through this confusing process step by step.

In this article, we’ll help you weigh the pros and cons of filing that insurance claim for roof damage. We’ll delve into understanding the severity of the damage, how to estimate repair costs, what your insurance policy covers, and much more.

Ultimately, our goal is to help you make an informed decision that brings peace of mind while securing your financial future.

So sit tight! This might be one of those discussions where a cup of tea on hand wouldn’t hurt!

Evaluating the Severity of the Damage

Before you rush off to file a claim, it’s crucial to assess how bad the damage really is; after all, we’re not talking about a few missing shingles caught in a gust of wind here. You need to take your time and carefully evaluate the severity of the roof damage.

So, grab a ladder and your courage (or enlist someone who has both) and inspect every nook and cranny of your roof. Look for signs of serious harm, like water leaks seeping into your attic or living spaces, sagging sections of the roof deck, or damaged flashing around vents and chimneys.

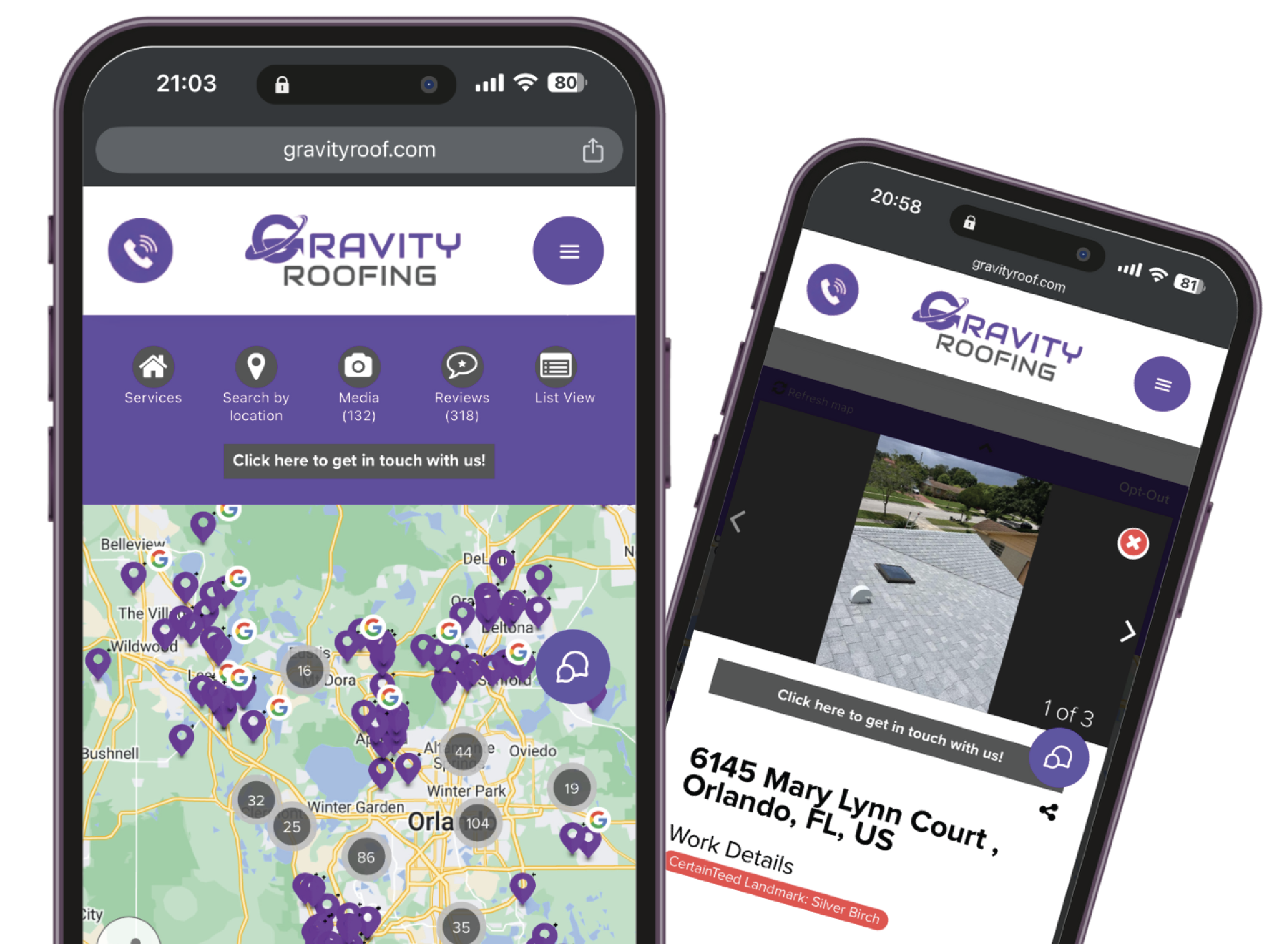

Don’t be hasty in filing that claim without doing this due diligence first. Consider reaching out to an expert roofing contractor if you’re unsure about assessing the damage yourself. They have the expertise to spot problems that might escape an untrained eye.

Remember, insurance companies aren’t always eager to pay out claims for minimal or superficial damages – their focus is on more substantial losses that significantly affect your home’s structure or safety. By understanding exactly what you’re dealing with before contacting your insurance company, you’ll be better prepared to navigate through what can often be a complicated claims process while also fostering more intimacy with your beloved sanctuary called ‘home’.

Determining the Cost of Repairs

Assessing the cost of repairs is a crucial step in your decision-making process. It’s like preparing a delicious meal – you need to know the cost of all ingredients before deciding whether it’s worth cooking or ordering take-out.

You might be surprised to find that minor roof damage, such as a few missing shingles, can often be fixed affordably on your own or with the help of a handyman. In these cases, filing an insurance claim might not make financial sense due to high deductibles and increased premiums down the line.

But what if your roof has sustained more significant damage? Maybe there’s a gaping hole caused by fallen debris during a storm, or widespread water leaks have led to structural decay. These are serious concerns that could drain your bank account faster than you can say ‘roof repair’.

In such scenarios, getting an accurate estimate from reputable professionals is essential. They’ll give you an honest appraisal so you can weigh up whether it makes more sense to dip into savings for repairs or file that insurance claim after all. Remember, knowledge is power when it comes to keeping both your roof and finances intact!

Understanding Your Insurance Coverage

Navigating your insurance coverage can seem like a maze, but it’s vital to understand what’s included and what’s not. You’re not alone in this journey; we’ve all been there! It begins with familiarizing yourself with your policy details—specifically how it pertains to roof damages.

You see, not all policies are created equal. Some cover full replacement costs, while others only cover the depreciated value of your roof at the time of damage. It’s crucial you don’t assume anything; get that magnifying glass out and read the fine print!

Now let’s talk about deductibles—the amount you’ll need to cough up before your insurance company steps in. This amount varies based on your policy and could significantly impact whether filing a claim is worth it or not. Also, keep an eye out for any clauses regarding ‘wear and tear’ or ‘routine maintenance’. These might give insurers an escape route from covering certain types of damages.

Remember, knowledge is power here! The more you know about your coverage, the better equipped you’ll be to make informed decisions when disaster strikes—and we’re right here with you every step of the way!

Considering the Impact on Future Premiums

While it’s critical to grasp your current coverage, it’s equally important to ponder on how filing a claim might affect your future premiums. Think about it – you’re sitting at home one stormy evening when you hear this ominous dripping sound.

A quick inspection reveals a leak in the roof and, of course, that’s something you’ll want to get fixed pronto. But wait! Before picking up the phone to dial your insurer, pause for just a moment. Sure, you’ve paid those premiums and naturally feel entitled to compensation for damages incurred. Yet, isn’t there a part of you wondering if making this claim will come back to bite?

You see, insurance companies often hike up premiums after claims are made – even if they’re not fault-based! They view any claim as an indication that you’re more likely to make another in the future; in their eyes, this makes you riskier and therefore more expensive to insure. It can be quite disheartening considering that hefty increase could linger around for years before gradually decreasing again (if indeed it ever does).

So even though claiming seems like the sensible thing right now, take some time out first. Consider whether the cost of repairing your roof would be less than the cumulative increase in your premium over time – that way, whatever decision you make will be grounded not only on present needs but also on long-term financial considerations.

Assessing the Likelihood of a Successful Claim

Before leaping headfirst into the claims process, it’s absolutely vital to gauge the odds of actually winning your case. This isn’t about being pessimistic, but rather being realistic and strategic.

Assessing the likelihood of a successful claim means taking a good hard look at both your insurance policy and the extent of your roof damage. You’ve got to understand what kind of damage is covered by your insurer, and whether or not that aligns with what’s happened to your roof.

Now, this does require some dedication on your part – you’ll need to go through those insurance documents with eagle eyes and perhaps even seek professional advice if things seem too technical or ambiguous. But remember, this effort could save you from an unnecessary headache down the line.

Don’t forget also that evidencing the cause and extent of damage is crucial in ensuring a successful claim – so snap those pictures, keep track of repair costs, note dates when damages occurred – every little detail counts!

So make sure you’re prepared before jumping into that claims battlefield; it’s all about playing smart here!

Weighing the Value of Peace of Mind

It’s hard to put a price on peace of mind, isn’t it?

We all know the feeling of lying awake at night, worrying about potential issues that could arise from an unresolved roof damage.

There’s something incredibly comforting about being able to close your eyes and sleep soundly knowing that in case of a rainy day or strong winds, your roof won’t let you down.

Filing a claim for your damaged roof might feel like an enormous task but think about the serenity awaiting you once it’s done.

Now imagine waking up each morning with a smile, confident in the knowledge that your home is properly protected from nature’s elements.

That kind of assurance can be priceless.

It lets you focus on what truly matters – enjoying life, nurturing relationships, pursuing dreams without the nagging worry over a leaky roof spoiling those precious moments.

So yes, filing that claim involves some effort and possibly some costs upfront; but if it buys you peace of mind?

Well darling, it may just be worth every penny!

Making an Informed Decision

Choosing to take action is empowering, isn’t it? The comfort of knowing that you’ve thoroughly examined your options and made a well-informed decision can fill you with confidence.

But when it comes to filing a claim for roof damage, the choice isn’t always black and white. There are numerous factors to consider: the extent of the damage, your insurance coverage, deductible amount, and potential premium increases. You’ll want to weigh these aspects carefully before making your move.

Now you’re in the driver’s seat – poised and ready to make an informed decision. What if we told you there’s no right or wrong answer here? It’s all about what feels best for you in your unique situation. Remember: this is about more than just a damaged rooftop; it’s about safeguarding your home—the cozy haven where memories are created and cherished.

So grab hold of that empowerment within you! Make your choice confidently, knowing that whether or not you file that claim for roof damage—your decision will be wise because it’s one born from careful thought and consideration.