You’ve probably heard the saying, ‘A man’s home is his castle.’ But just like any fortress, your house needs protection too—not only from natural disasters but also from everyday wear and tear. You’ve done the responsible thing by getting a home insurance policy to safeguard your humble abode.

Yet, do you truly get the nitty-gritty of what it covers or doesn’t? Let’s specifically talk about that roof overhead—your first line of defense against Mother Nature.

If you’re honest with yourself, all those insurance jargons can be daunting as climbing a slippery roof itself! But don’t fret—we’re here to help you decode your home insurance policy when it comes to roof repair.

We’ll guide you through understanding the basics and beyond, identifying types of damage covered, unveiling hidden clauses, recognizing policy exclusions, and even some secret strategies for cost reduction.

So pop open that policy document—it’s time to navigate this journey together and ensure your peace of mind!

Understanding Your Policy: Basics and Beyond

Don’t let the fine print of your home insurance policy intimidate you; it’s essential to know what’s covered and what isn’t, especially when it comes to roof repair.

You see, every little clause and phrase in that document plays a role in defining the scope of protection provided by your insurer. So consider this: the time you spend understanding your policy today might just save you from a world of financial hassle tomorrow.

And remember, it’s not only about knowing what is covered but also being aware of any exclusions or limitations.

Now, don’t think for a second that this will be an overwhelming task. Take it one step at a time.

Start off by familiarizing yourself with basic coverage options like dwelling coverage for structural damage or personal property coverage for loss or damage to your possessions due to perils such as fire, theft, or hailstorms.

Then move onto more specific aspects like whether damages caused by natural disasters are included in your plan since these can have significant implications on roof repairs after storms or hurricanes.

It won’t be long before you start feeling confident in navigating those complex insurance terms and conditions!

Identifying Types of Damage Covered

In exploring the ins and outs of your policy, you’ll find it covers a surprising range of mishaps, from storm damage to fires. For instance, if a tree branch crashes through your roof during a hurricane or a lightning strike sets your shingles aflame, you can breathe easy knowing that these disasters typically fall within the domain of standard coverage.

But wait! Before you do that happy dance thinking everything is covered under the sun – remember there’s always more to it than meets the eye.

Not all damages are created equal in the eyes of your insurance company. Here’s where things get tricky – what if wear-and-tear over time has led to leaks? Or suppose those pesky pests have set up camp in your attic and chewed through important structures? Unfortunately, situations like these may not be covered by default on your policy due to their classification as ‘maintenance issues’.

So take some time to really dig into those policy documents or better yet, have an intimate tete-a-tete with your insurance agent to ensure you’re not left out in the rain when it comes to paying for roof repairs.

Unveiling Hidden Clauses

You’ve got to be a bit of a detective when it comes to finding those hidden clauses in your policy that could make all the difference. Let’s face it, insurance documents aren’t exactly bedtime reading material, but they’re brimming with secrets just waiting to be discovered.

We’re talking about ‘Exclusions,’ ‘Limitations,’ and the ever-mysterious ‘Endorsements.’ These are not just fancy words; they hold the power to decide if your roof repair will come from your pocket or the insurer’s.

Now, here’s where things get interesting. Those exclusions? They’re items that your policy won’t cover under any circumstance – like damage from neglect or normal wear and tear. Limitations cap how much money you can receive for certain types of damage.

As for endorsements, well, think of them like bonus features on a DVD: additional coverage options you can purchase on top of your existing plan. So grab that magnifying glass and start sleuthing through your policy terms because knowing these secrets can save you big bucks down the line!

Recognizing Policy Exclusions

Ready to tackle those pesky policy exclusions head-on? Let’s dive right in and unearth what they really mean for your wallet.

When it comes to home insurance and roof repairs, you might feel like you’re reading a foreign language with all the jargon and fine print. But don’t worry, we’re here to demystify the lingo.

Essentially, policy exclusions are things that your insurance won’t cover. Sounds straightforward, right? Unfortunately, these exclusions can often be vague or not clearly spelled out, leaving many homeowners surprised when their claim gets denied.

Now let’s discuss this from a roofing perspective. Most policies will cover damage caused by unforeseen or sudden events like fire or severe weather conditions – think hailstorms or hurricanes. However, if your roof has been slowly deteriorating over time due to lack of maintenance or general wear and tear – sorry folks – that’s where the exclusion kicks in! Your insurer will likely argue that as a homeowner, it’s your responsibility to maintain your roof properly. Frustrating? Yes! But once you understand these potential pitfalls in advance, it gives you a chance to take preventative measures – regular inspections anyone? Remember, knowledge is power – especially when it comes to safeguarding one of your most valuable assets – your home.

Strategies for Cost Reduction

So, you’re eager to shrink those sky-high insurance costs? Let’s delve into some savvy strategies that could lead you to a path of significant savings.

One tried and true method is bundling your home and auto insurance with the same provider. Insurance companies often reward this loyalty with discounted rates that can put a smile on your face. Furthermore, boosting your policy’s deductible may also pave the way for lower premiums. Just remember, while this tactic can save money in the short term, it means you’ll be footing more of the bill if disaster strikes.

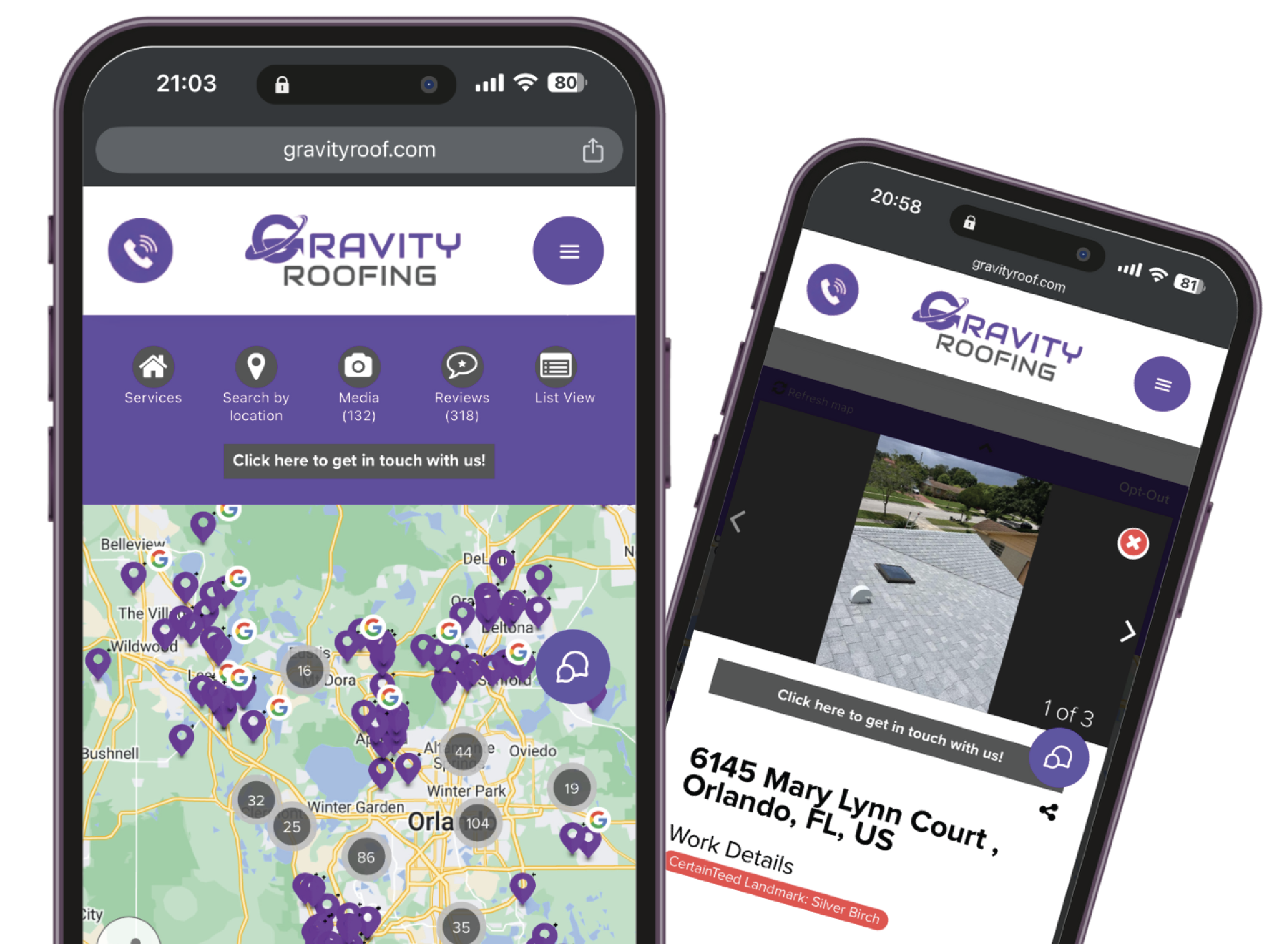

Another smart move is to invest in roof maintenance. Regular check-ups by a professional roofer can catch small issues before they become costly problems, potentially saving you from filing an insurance claim down the line. Not only does this keep your hard-earned money in your pocket, but it also reduces the risk of having rates hiked due to claims history.

And lastly, don’t forget to ask about discounts! You’d be surprised how many insurers offer price cuts for everything from having a security system installed to being a long-term customer. When it comes to insurance costs, every little bit helps!

Navigating Insurance Claims

Navigating the often complex world of insurance claims can feel like you’re trudging through a dense fog, but don’t despair – we’re here to light your way.

First things first: when it comes to roof repairs, remember that time is of the essence! Don’t dawdle once damage is spotted; contact your insurer promptly and start documenting everything right away.

Photos, notes about weather conditions leading up to the damage, even conversations with contractors – these all carry weight in building your claim case. Of course, keep any repair receipts safe too; they’ll be vital when demonstrating costs.

Now let’s get personal for a moment. I know dealing with insurance companies can sometimes leave you feeling cold and isolated – just another number on a spreadsheet. So let me reassure you that this doesn’t have to be the case!

You’ve invested a significant amount into your home insurance policy, so don’t hesitate to ask questions or request clarification if something isn’t clear. Remember: an informed homeowner is an empowered one.

And while it might seem daunting now, rest assured that many before you have successfully navigated this path and come out the other side triumphant – why shouldn’t you?

When to Consider Policy Upgrades

After successfully navigating the labyrinth of your insurance claims, it’s time to consider another crucial aspect. You’ve weathered through the storm, but how can you prepare yourself for future uncertainties?

It’s all about looking at potential policy upgrades. Think of your home like a living entity. It grows, it ages, and sometimes, it even gets sick—and when that happens, you want to make sure you have the best possible coverage.

There are times when standard home insurance just doesn’t cut it anymore. Maybe you’ve done significant renovations to your roof or added solar panels; these changes often increase your property’s value and therefore require more comprehensive coverage.

An upgraded policy may cost a little more upfront but could save you big in the long run if something goes wrong with your roof again. Always remember: peace of mind is priceless!