Master Your Storm Damage Insurance Claims Fast

Experiencing storm damage can be overwhelming, but understanding how to handle storm damage insurance claims effectively is crucial to restoring your home and peace of mind. In Central Florida, where storms are common, knowing the steps to take can make all the difference. Storm damage typically includes wind, hail, and flood damage, each requiring specific actions for insurance claims. Wind damage can strip shingles off your roof, hail can cause significant impact damage, and flooding can lead to severe structural issues. This comprehensive guide will walk you through the process of handling insurance claims after storm damage, ensuring you’re well-prepared to restore your home.

Immediate Steps to Take After a Storm

Prioritize Safety and Assess the Damage

The first step after a storm is to ensure your safety and assess the damage. Inspect your property for visible damage, focusing on the roof, structural elements, and potential hazards. Here’s a detailed guide to help you:

- Inspect the Property: Start with a thorough inspection of your property. Look for roof damage, such as missing or cracked shingles, and structural damage to walls and foundations. Check for leaks, fallen trees, and any other visible hazards.

- Prioritize Safety: Avoid walking through water or debris that might be electrified or contain sharp objects. Wear sturdy shoes and gloves during your inspection.

- Check Plumbing and Electrical Systems: Inspect your plumbing for any leaks or damage. Shut off the main valve if you suspect any issues. Similarly, check your electrical system for exposed wires or other hazards, and shut off the main power if necessary.

Documenting the Damage

Proper documentation is vital for a successful insurance claim. Here’s how to do it effectively:

- Take Clear Photos and Videos: Capture images and videos of all visible damage. Include multiple angles and close-ups to ensure nothing is missed. Document both the exterior and interior damage thoroughly.

- Keep Detailed Records: Maintain a record of all damaged areas and items. Note the date and time of the storm and any subsequent damages discovered.

Contacting Your Insurance Company

Initiating the Claim

Once you have assessed and documented the damage, it’s time to contact your insurance company:

- Notify Your Insurer: Call your insurance company as soon as possible to report the damage. Provide a detailed account of the damages and your documentation.

- Submit Documentation: Send all photos, videos, and records to your insurer. This will help expedite the claim process.

- Receive Claim Number: Your insurance company will assign a claim number and provide you with the next steps, including scheduling an adjuster’s visit.

Working with an Adjuster

An insurance adjuster will visit your property to assess the damage:

- Prepare for the Adjuster’s Visit: Ensure the adjuster has access to all areas of damage. Share your documentation and point out all damaged areas.

- Assist with the Inspection: Accompany the adjuster during the inspection to ensure all damages are noted. Ask questions if you need clarification on any part of the process.

Making Temporary Repairs

Securing the Property

Prevent further damage by making necessary temporary repairs:

- Tarping and Boarding Up: Use tarps to cover damaged roofs and board up broken windows. This helps prevent additional water damage and keeps your home secure.

- Keep Receipts: Save receipts for all materials and services used for temporary repairs. These expenses are typically reimbursable by your insurance company.

Choosing a Contractor

Selecting a Reputable Contractor

Choosing the right contractor is crucial for quality repairs:

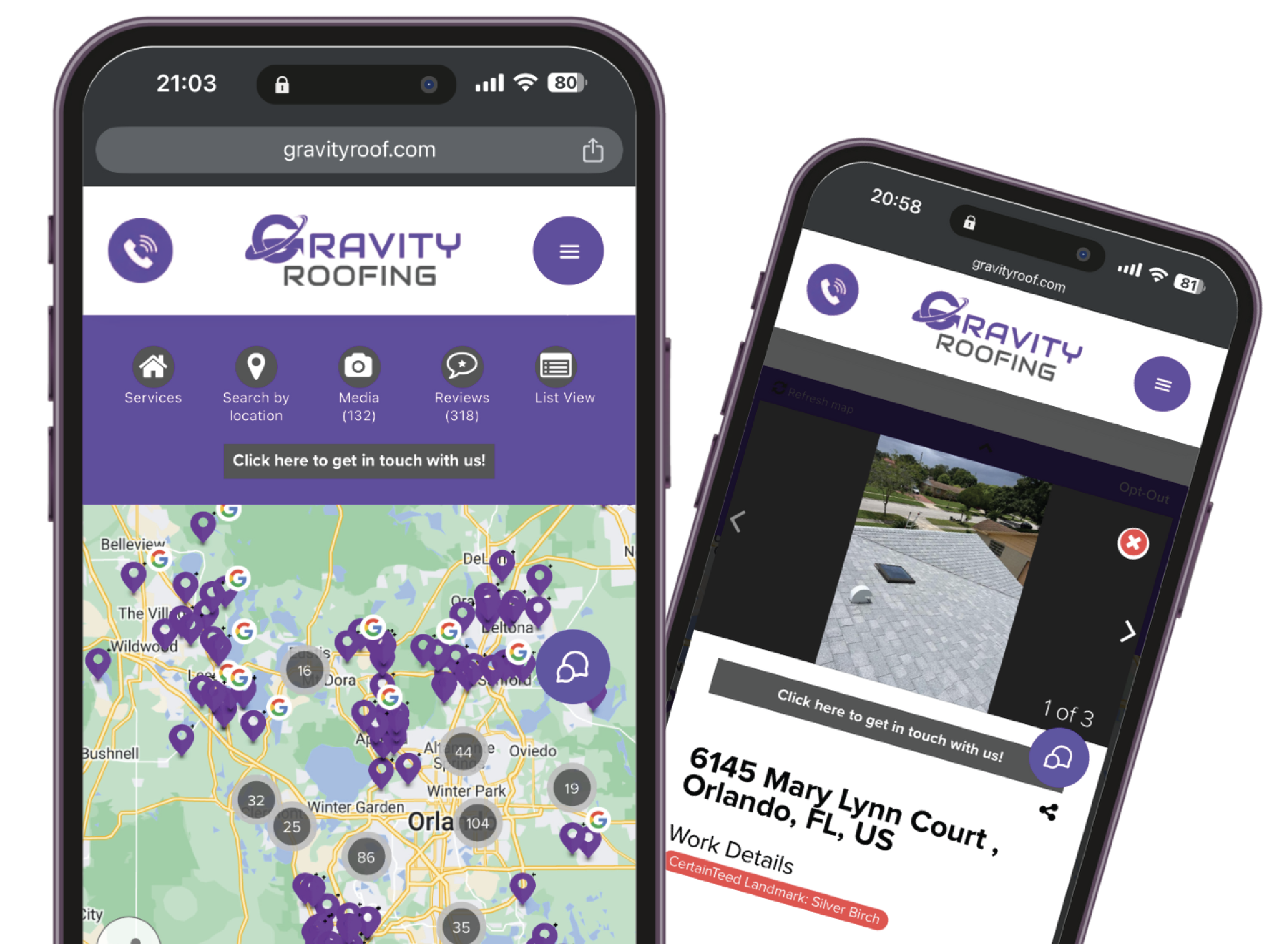

- Research and Verify: Look for licensed and insured contractors with experience in storm damage insurance claims. Gravity Roofing, based in Central Florida, specializes in these types of repairs and can be a reliable choice.

- Avoid Scams: Be cautious of contractors demanding full payment upfront or those without proper credentials. Check out Gravity Roofing’s 175 5 Star Reviews

Getting Estimates

Obtain multiple estimates to compare costs, but be aware that the insurance company may approve the lowest bid. Ensure the estimates cover the full scope of work needed to restore your property.

Finalizing the Claim

Repair and Restoration Process

Once the claim is approved, the contractor will begin repairs:

- Follow Adjuster’s Recommendations: Ensure repairs are made according to the insurance adjuster’s recommendations and scope of work.

- Submit Final Documents: After repairs, submit all necessary documents to your insurance provider for final payment and claim settlement.

Tips for Handling Storm Damage Insurance Claims

Know Your Policy

Understanding your homeowner’s insurance policy is essential:

- Coverage Details: Know what is covered under your policy, including specific exclusions and deductibles for storm-related claims.

- Higher Deductibles: Be prepared for higher deductibles for certain types of storm damage.

Keep Track of the Claim

Stay informed about your claim status and respond promptly to any requests from the insurance company. Regular follow-ups can expedite the process and ensure all necessary steps are completed.

Preventing Future Storm Damage

Proactive Measures

Take proactive steps to minimize future storm damage:

- Regular Maintenance: Trim trees, secure loose items, and perform regular roof inspections.

- Quality Materials and Services: Invest in high-quality materials and professional services for any repairs and upgrades to enhance the durability of your home.

Conclusion

Handling storm damage insurance claims can be complex, but with the right steps, you can navigate the process smoothly. Prompt action, thorough documentation, and working with reputable contractors like Gravity Roofing in Central Florida can ensure your home is restored efficiently. Stay prepared, know your policy, and take preventive measures to protect your home from future storms.

By integrating these steps into your response plan, you can effectively manage storm damage and navigate the insurance claims process with confidence and clarity.